Thinking about using KiwiSaver to buy a first home?

Honestly, KiwiSaver or no, buying a house is kind of a nightmarish process. I was going through some files on my computer the other night and came across some finance documents from my mortgage application days. I couldn’t bring myself to delete them in case I wind up needing them for something again, but I definitely did not linger on them. You can bet I clicked away FAST.

It’s been over a year, and thankfully the memories of that traumatic time have faded. But I thought I’d jot down the steps involved for anyone who might find it useful, before I forget entirely. And it seems like Auckland’s crazy runaway house price growth may finally have slowed. So if you are thinking about braving the market as a first home buyer, here’s a rough guide based on my experience of using the KiwiSaver withdrawal option for a first home.

1. Apply for HomeStart grant preapproval (if you meet the criteria)

The HomeStart grant is a feature of the KiwiSaver scheme that gives you a cash grant toward buying a first home. There are income limits (less than $85,000 for one, or less than $130,000 for two or more people), house cap limits ($600k for an existing house in Auckland or $650k for a new build; less in other regions of NZ), and you must have been contributing to KiwiSaver for at least three years.

Other criteria apply too – eg you’ll need to live in the house for at least six months and have at least a 10 percent down payment (although that can include the HomeStart grant itself, and of course your own KiwiSaver first home withdrawal funds).

With the HomeStart first home grant you can get $1,000 for each year that you’ve contributed to KiwiSaver, to a minimum of $3,000 and a maximum of $5,000. If you’re buying a new build, all of these figures double – $2,000 per year of contributions, to a minimum of $6,000 and maximum $10,000!

You can get pre-approval for the KiwiSaver first home grant, which is valid for six months. And you can do it all online. I received pre-approval within a couple of days via email!

Don’t leave it until settlement or you might miss out entirely – you need to apply, at a minimum, 20 working days before your settlement date. Get preapproved, seriously!

Note: I did not actually wind up using the HomeStart grant in the end, so I can’t speak to the latter parts of the HomeStart process beyond getting pre-approved.

If you meet the criteria for the HomeStart grant, then you will presumably also meet the criteria for the Welcome Home loan scheme…

2. Apply for a Welcome Home Loan (if you meet the criteria)

Welcome Home Loans are a government initiative for first home buyers who only have a 10% deposit. Not all lenders offer these loans. You can apply directly to the lenders listed on the site, or you can go through a broker (I used a mortgage broker recommended by a friend).

Getting preapproved took bloody ages, to be honest. The Welcome Home Loan application has to go to Housing New Zealand and I believe there was a backlog at the time I applied, and I literally had to wait a month to hear back.

Note: I did not actually wind up using a Welcome Home Loan in the end, so I can’t speak to the latter parts of the process beyond getting pre-approved.

3. Apply for a KiwiSaver first home withdrawal (anyone and everyone)

You can basically skip ahead to this step if you don’t qualify for/want to use the HomeStart and Welcome Home Loan options. You would want to have sorted out your mortgage preapproval before this step, though.

In my case, despite having jumped through all the hoops already, I wound up receiving some 11th hour financial help from family which meant I ditched the HomeStart/Welcome Home Loan path, and got a generic bank mortgage.

As soon as you sign the sale and purchase agreement on a house, apply directly to your KiwiSaver provider for a first home withdrawal. Again, do not leave this until the end! Your provider will probably require 10-20 working days to process your request for a KiwiSaver withdrawal as a first home buyer. I think mine took almost two weeks. You can request to withdraw a certain amount, or the full balance (that said, you must leave a minimum of $1000 in your account, so you can’t totally drain it).

If approved, your KiwiSaver provider will transfer the money to your lawyer’s bank account. It never actually passes through you.

A note about deposits and KiwiSaver

I didn’t realise this, but there are actually two aspects to the deposit involved in buying a house: the portion you pay the agent and the portion you pay the lawyer.

What we generally talk about when we talk about deposits is the amount you need to put toward the purchase price, from the lending perspective (usually 20% these days, 10% under the Welcome Home Loan) – which you pay to your lawyer’s account prior to settlement day.

But there’s also the vendor deposit – the money you pay to the real estate agent to secure the house. This may be payable upfront upon signing the sale and purchase agreement as in my case. In some cases you might be able to arrange to defer this until the day of going unconditional, but obviously from the seller’s point of view it’s in their interests that you stump up some cash upfront as proof of your commitment to the sale.

Realistically, I don’t see how you could use KiwiSaver for the initial vendor deposit. Depending on the timeframes involved in your particular transaction … if most of your deposit is coming out of your KiwiSaver, this might pose an issue.

You can’t use a HomeStart grant to pay the seller’s deposit, so that’s not an option. If you’re relying on using KiwiSaver withdrawal funds for the vendor deposit, you’d have to negotiate payment upon going unconditional, and a long conditional period. You need to send in your sale and purchase agreement with your withdrawal application forms, but it takes time to process all of that (10 working days minimum with my provider, for example). If the vendor insists on a shorter conditional period (5 business days is common), make sure you have access to enough cash in a pinch! I saw a post online the other day where the buyers took out an overdraft for this exact purpose, because they got caught out by this.

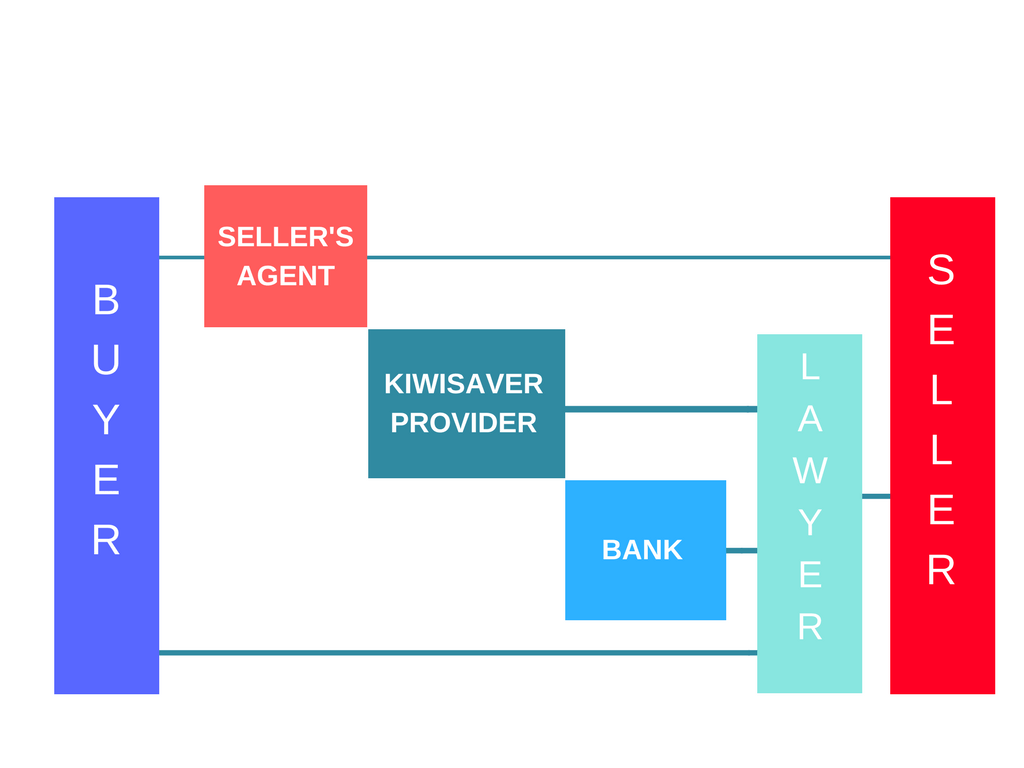

Here’s my attempt to visually interpret the cashflows involved during this process.

For example, let’s say you have a 20% deposit, of which half comes from your KiwiSaver. First you might pay 5% to the agent, then 10% is withdrawn from your KiwiSaver and sent to your lawyer. You send the last 5% of your cash deposit to your lawyer. The remaining 80% is drawn down from your mortgage and transferred from bank to lawyer. This all adds up to 100% by settlement day and is finally sent to the vendor.

There you go – that’s my take on buying a house with KiwiSaver as a first home buyer! As I said, I can’t speak to using the KiwiSaver Homestart first home grant/Welcome Home Loan all the way through, but I can tell you for sure what it would add more complexity and paperwork at the end. Be prepared!